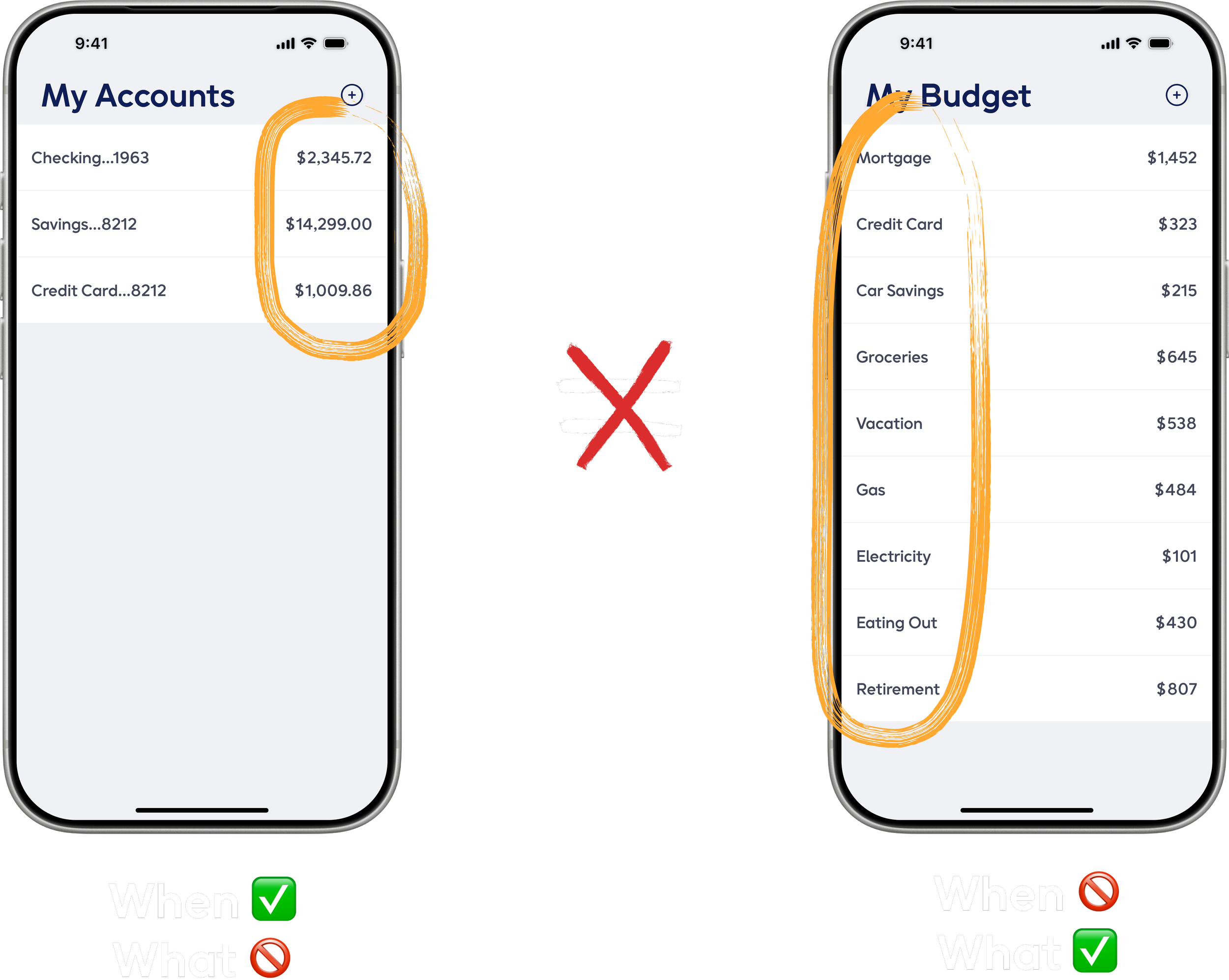

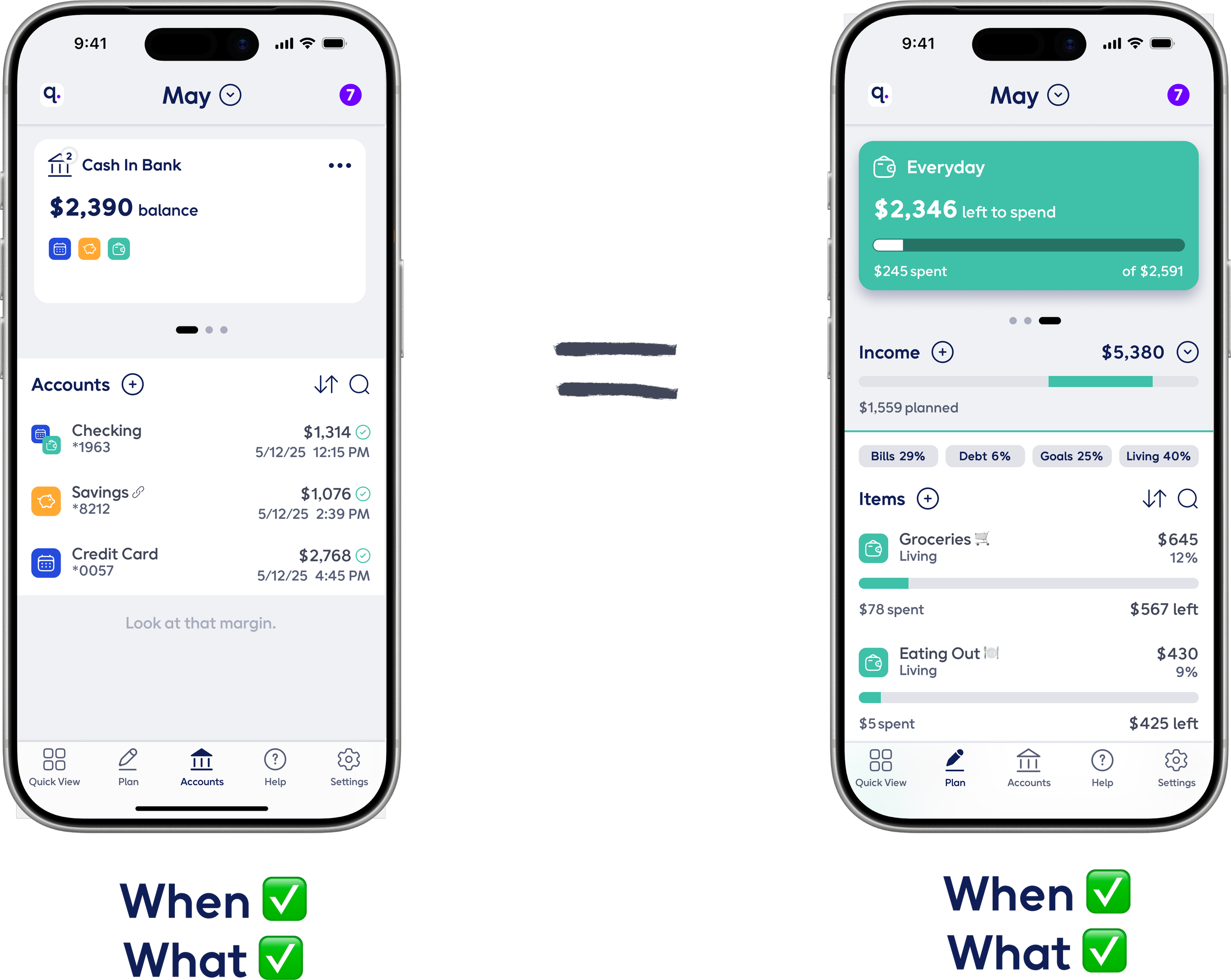

Ever had your bank account and budget not line up?

Yeah, us too.

The Problem:

Your budget only shows what you plan to spend money on.

It doesn’t tell you when you’ve spent money on those things (unless you constantly track it).

Your bank balance only shows when money is spent (and changes everyday!)

It doesn’t tell you what you’ve spent money on (unless you sift through every transaction).

The Solution:

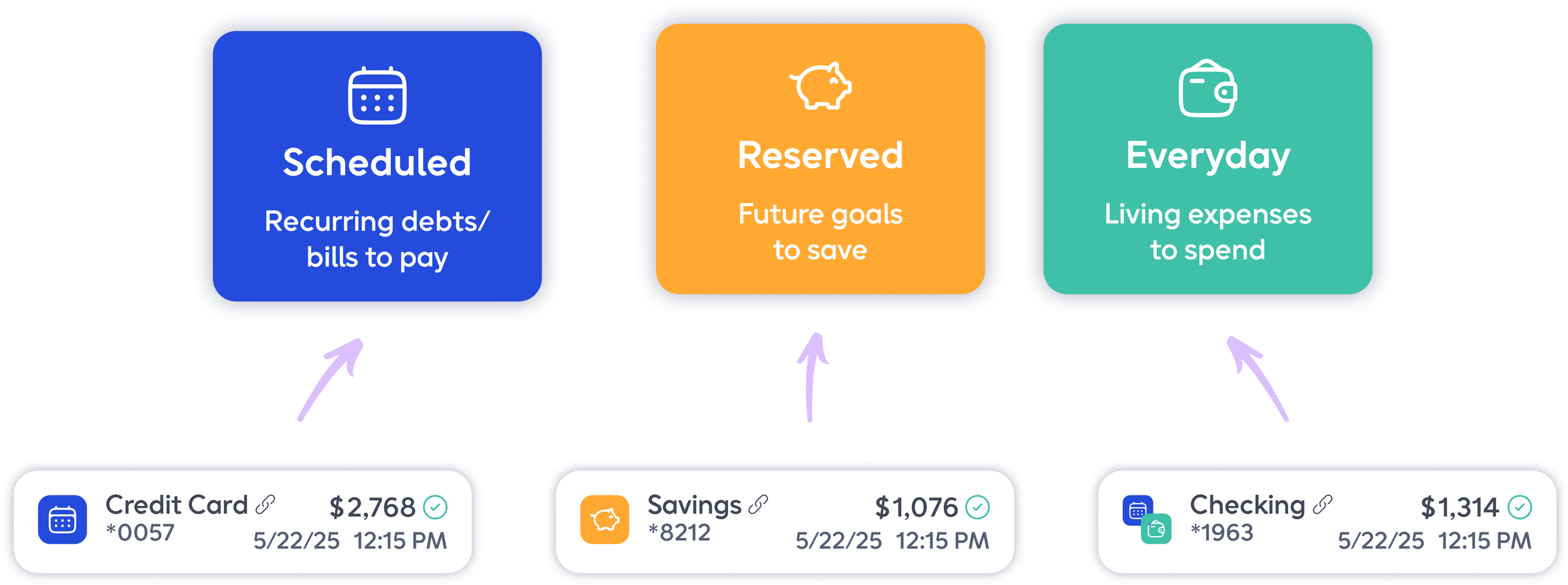

Quse works on the concept of three time-based queues—Scheduled, Reserved, and Everyday.

Bills or debts with a due date you pay monthly.

Think mortgage, credit cards, utilities, streaming services, and loans.

Goals with an amount or date to save by to spend later.

Think a vacation, retirement, down payment, and car insurance.

Daily or weekly living expenses you spend throughout the month.

Think groceries, gas, eating out, prescriptions, and clothes.

Each queue represents a different spending purpose for a portion of your monthly income.

Quse looks at your budget and knows how to divide your income up over these three queues. You know exactly where each transaction is being spent from.

And you only have to pay attention to three numbers each month—that’s it!

Start by connecting your accounts.

When connecting your bank accounts in Quse, you tell each account its spending purpose by associating it with a time-based queue.

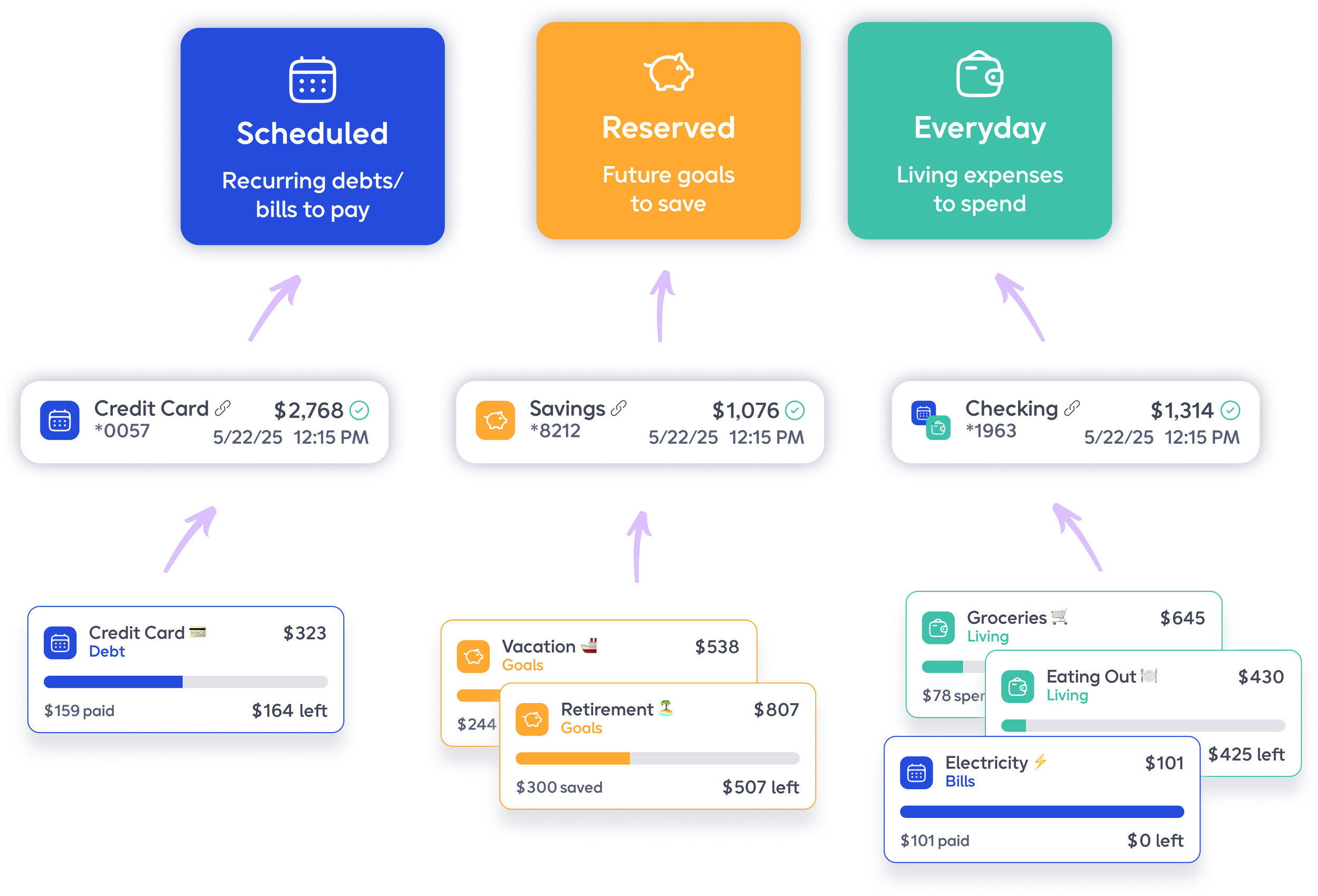

Then list your monthly items.

When you list the items you plan to spend your income on for the month, you decide if that item is a bill, debt, goal, or living expense. Based on its type, Quse then assigns it to a queue.

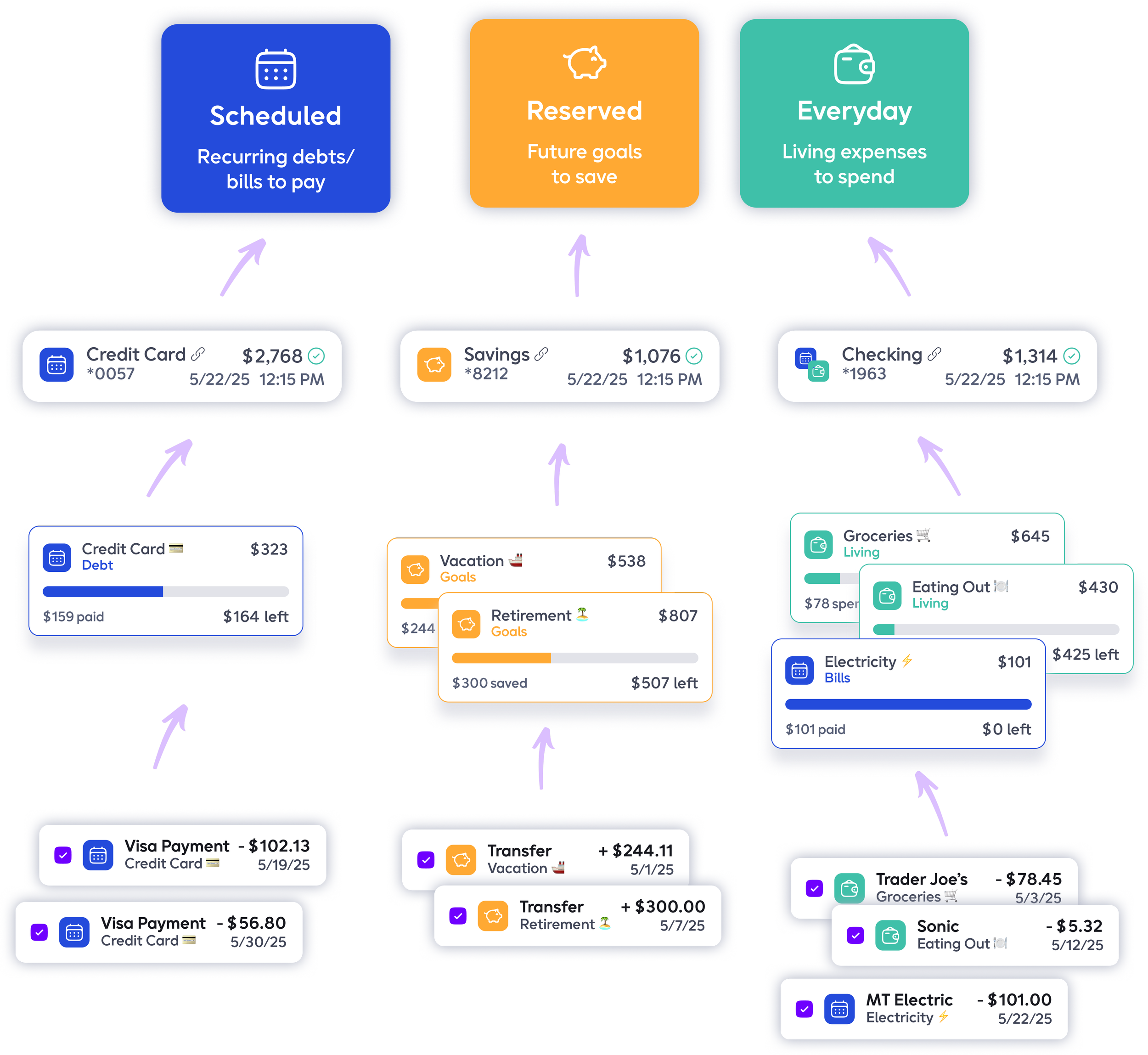

Confirm transactions to track spending.

With your accounts connected, Quse will start bringing in transactions already designated to the right budget items.

All you have to do is hit Confirm.

Enjoy the alignment of your bank and budget.

Because your bank accounts are your queues, your budget always matches your bank.

All you have to do is look at three numbers to stay on track during the month. Isn’t that easy?